Chinese-Linked Loan App Involved In Extortion, Multi-Crore Fraud Busted In Delhi, 8 Arrested

Delhi Police busted a gang that was allegedly involved in illegal loans extortion and harassment of borrowers in the national capital. A total of eight people were arrested for allegedly extorting money from people using their morphed pictures obtained through a bugged loan app. The scam was exposed when a Delhi-based woman a victim of the app filed a complaint with the police alleging that she was being harassed by a few people for money.

The Intelligence Fusion and Strategic Operations (IFSO) unit of the Delhi Police has busted a gang that was allegedly involved in illegal loans, extortion and harassment of borrowers, in the national capital.

A total of eight people were arrested for allegedly extorting money from people using their morphed pictures obtained through a bugged loan app.

BCCL

BCCL

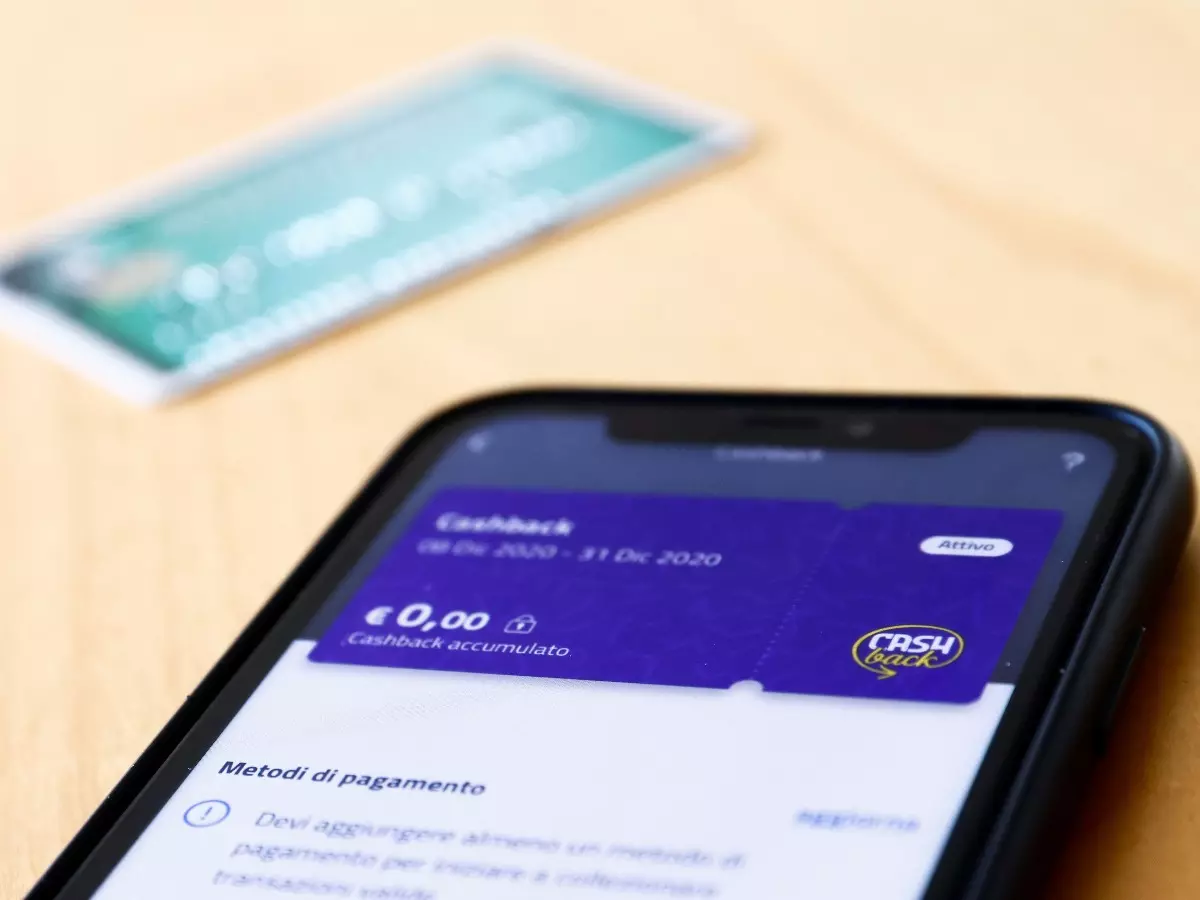

According to the Delhi Police, the app in question, 'Cash Advance' (Danakredit), which was available for download on Play Store, offered short-term loans to users.

Like similar cases in south India last year, the app targeted people who were looking for a quick loan to meet their urgent needs.

The borrowers were made to install the app on their phones, which the scamsters then used to get access to their contacts list, gallery, and other personal data.

The gang then used stolen personal data, including morphed photos to threaten their victims into paying large amounts.

How the gang was exposed

The scam was exposed when a Delhi-based woman, a victim of the app, filed a complaint with the police alleging that she was being harassed by a few people for money.

Reuters

Reuters

The woman in her complaint said that she had taken a loan from Cash Advance app and had paid the money back. But afterwards, she began getting calls for money from some people, who used abusive language with her and even sent her morphed pictures to her family and friends.

According to police, the woman alleged that one of the accused used picture of a senior IPS officer for his WhatsApp profile.

Based on the woman's complaint, a case was registered and the money trail of the alleged transaction was figured out.

What the investigators found

It was found that the money was being transferred to a current account opened in the name ¡®Balaji Technology', a motorcycle repair shop, which was owned by one Rohit Kumar, a senior police officer said.

Police found that the account was used to funnel approximately Rs 8.45 crore in just 15 days to other accounts.

Reuters

Reuters

In all, police identified 25 more such accounts and froze them, he said.

Subsequently, raids were conducted on March 13 in Pitampura and Rohini from where police arrested four people involved in the scam, Deputy Commissioner of Police (IFSO) KPS Malhotra said.

The accused were identified as Rohit Kumar, Vividh Kumar, Puneet, and Manish. Their mobiles and other devices used in the crime were also recovered from them.

Later, two more accused, a man named Puneet Kumar and a woman, who remains unidentified, were arrested, along with one Krishna, who was identified as the mastermind of the whole operation, he said.

Krishna was arrested from Jodhpur in Rajasthan on March 14, police said.

Krishna, the mastermind in India, provided all the bank accounts to one Chinese national. It was revealed that all extortion money was being sent to China through cryptocurrency by him.

¡°Crypto accounts of three Chinese nationals have been identified," the officer said.

Later, police arrested another accused, Sumit, from Gurugram.

Sumit ran the operation to make WhatsApp calls through a number obtained using fake documents.

When interrogated, he led the police to another accused, Kartik Panchal, whom he identified as the team leader of the operation.

Panchal too was arrested, police said.

"We found that Panchal was running a team of callers who used to make calls to the loan seekers. It was also found that the accused morphed and edited pictures of women and sent them to their contacts to extort money from them," Malhotra said.

The loan app brandished a fake NBFC agreement and privacy policy and attracted clients with special offers.

Screengrab

Screengrab

Not a new phenomenon

Non-registered Chinese loan apps had been under the scanner in India since 2021, during the height of the COVID-19 pandemic.

They had targeted youths who had lost their income due to the lockdowns.

Since it is instant approval, without any paperwork or other usual formalities, people who are in urgent need of cash will fall for it.

After a flood of complaints, mostly from Telangana and some reported deaths due to harassment, Google had cracked down on such apps and banned them from the Play store.

For more on news, sports and current affairs from around the world, please visit Indiatimes News.