GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier

The 47th Goods and Services Tax (GST) Council meeting, headed by Union Minister for Finance and Corporate Affairs Nirmala Sitharaman, concluded in Chandigarh on Wednesday.

The 47th Goods and Services Tax (GST) Council meeting, headed by Union Minister for Finance and Corporate Affairs Nirmala Sitharaman, concluded in Chandigarh on Wednesday.

The Council directed that the Group of Ministers on Casino, Race Course and Online Gaming re-examine the issues in its terms of reference based on further inputs from States and submit its report by July 15 as Goa has raised the issue and asked to differentiate the Casino from online gaming and horse racing.

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | Twitter

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | Twitter

"Following Goa's request for special treatment for casinos, it was decided that GoM will give one more hearing for online games and horseracing as well; the GoM will submit the report by July 15 and GST Council will hence meet again on this GoM's agenda in 1st week of August", said the Finance Minister.

After the recommendations that were taken up in the two-day 47th GST Council meeting in Chandigarh on Wednesday, a number of goods and items are set to attract GST after the council approved changes in the tax rates with effect from July 18, 2022.

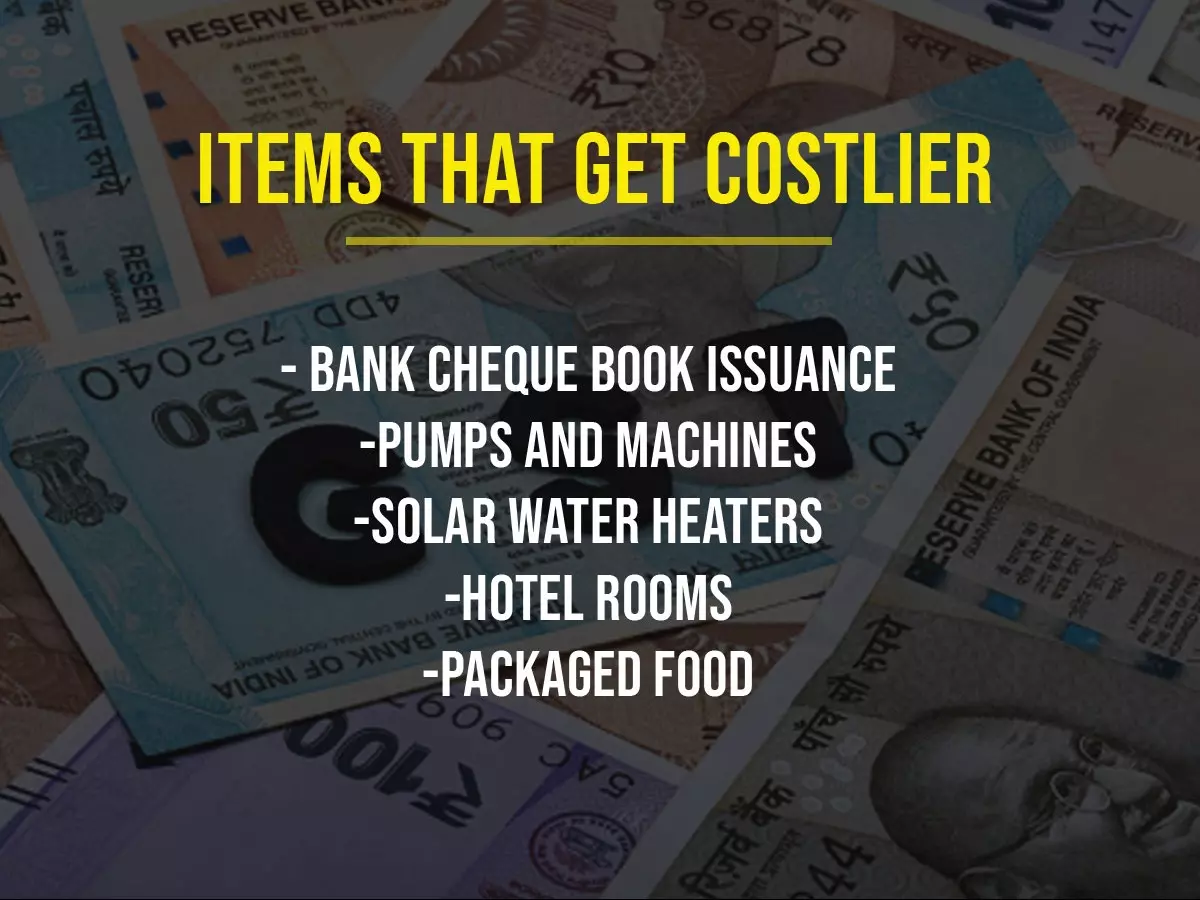

Items that get costlier after GST rates revised

From LED lamps to solar water heaters and various job works, here are the items that get costlier after GST rate revision.

Bank cheque book issuance

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | File Photo

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | File Photo

An 18 per cent GST will be levied on the fee charged by banks for the issue of cheques.

Pumps and Machines

GST on power driven pumps primarily designed for handling water such as centrifugal pumps, deep tube-well turbine pumps, submersible pumps, Bicycle pumps have been increased from 12 per cent to 18 per cent.

Machines for cleaning, sorting seed, grain pulses; Atta Chakki etc, will also attract GST rates of 18 per cent as opposed to 12 per cent earlier.

Solar water heaters

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | kenbrooksolar.com

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | kenbrooksolar.com

The GST rate on solar water heaters and systems has been hiked to 12 per cent from 5 per cent.

Hospital beds

Excluding ICU, Room rent exceeding Rs 5000 per day per patient charged by a hospital shall be taxed to the extent of amount charged for the room at 5 per cent without ITC.

Hotel rooms

The GST Council also decided to bring hotel rooms under Rs 1,000 per day under the 12 per cent GST slab, as opposed to tax exemption category at present.

Packaged food

Pre-packed and labelled meat (except frozen), curd, honey, fish, lassi, paneer, dried leguminous vegetables, wheat and other cereals all goods and organic manure and coir pith compost will not be exempted from GST and will now attract a 5 per cent tax.

LED Lights, Lamps

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | Unsplash

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | Unsplash

GST on LED lamps, lights and fixtures and their metal printed circuit board has been hiked to 18 per cent from 12 per cent GST.

Leather goods

GST rate on job work in relation to manufacture of leather goods and footwear has been increased to 12 per cent from 5 per cent.

Items that get cheaper after GST rates revised

Electric vehicles

Electric vehicles whether or not fitted with a battery pack, are eligible for the concessional GST rate of 5 per cent.

Defence Items

Defence Items GST | Twitter

Defence Items GST | Twitter

IGST on specified defence items imported by private entities/vendors, when end-user is the Defence forces have been exempted from GST.

Orthopedic Appliances

Items like fracture appliances, artificial parts of the body, other appliances which are worn or carried, or implanted in the body, to compensate for a defect or disability; intraocular lens will now attract a GST rate of 5 per cent as opposed to 12 per cent earlier.

Ropeway Rides

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | Curlytales

GST Rates Revised: Here¡¯s The List Of Items That Gets Cheaper & Costlier | Curlytales

The GST council has slashed the rates of GST on transport of goods and passengers through ropeways from 18 per cent to 5 per cent with Input Tax Credit services.

Good Carriage Rent

Rent of trucks that carries goods and where the cost of fuel is included will now attract a lower 12 per cent rate as against 18 per cent.

For more on news and current affairs from around the world please visit Indiatimes News.