Reserve Bank of India Monetary Policy, Updates And Key Points

The Reserve Bank of India announced its sixth bi-monthly monetary policy statement for 2019-20 today. The Repo Rate was kept unchanged 515 % which was widely expected. The Monetary Policy Committee upped the inflation outlook for the second half of the next fiscal year by 030 per cent to 54 - 5 per cent.

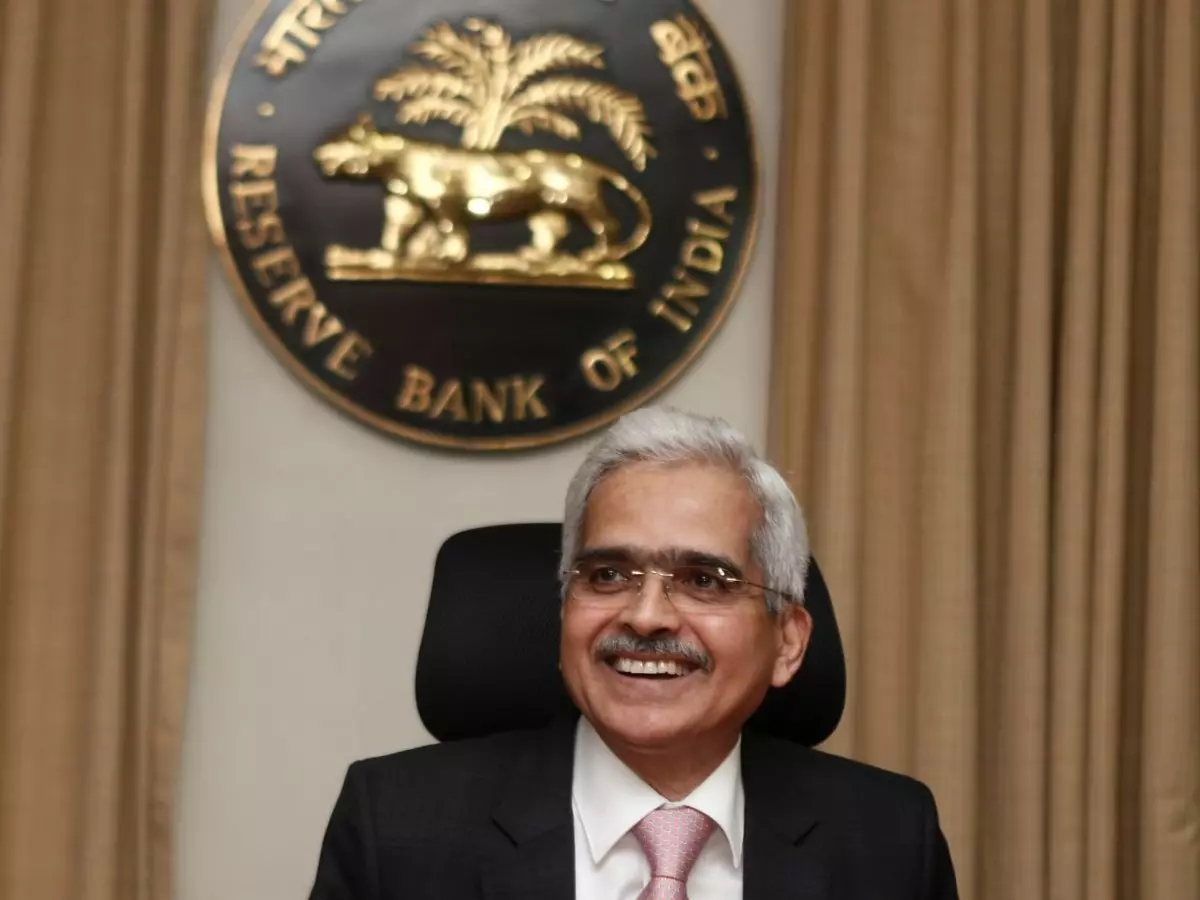

AFP

AFP

The Reserve Bank of India (RBI) announced its sixth bi-monthly monetary policy statement for 2019-20 today in which the Repo Rate was kept unchanged 5.15 % which was widely expected. The Monetary Policy Committee is led by Governor ShaktiKanta Das who said it has decided to keep policy unchanged at 5.15% and persevere with the accommodative stance as long as it is necessary to restore the growth, while ensuring that inflation remains within the target.

Repo Rates is a rate at which the RBI lends to the bank and Reverse Repo Rate is at which it borrows it from the bank.

Key Points From The RBI Monetary Policy:

AFP

AFP

RBI said the increase in limit of deposit insurance is not likely to impact the balance sheet of any banks due to the increase in premium outgo.

The RBI announced that the premium for bank deposits is being increased to 12 paise from 10 paise for the time being.

Yes Bank, Chief Economist Shubhada Rao said ¡°The RBI¡¯s rate decision is in line with the expectations. It is most likely to maintain a status quo in the near term. With an inflation forecast of 3.2% factored in for Q3 FY21, in conjunction with our forecast, we expect RBI rate action in October 2020 monetary policy. (We) expect 25 bps rate cut then.¡±

RBI Governor ShaktiKanta Das said that continuity in policy from the last pause taken should not be read as a pointer to future actions. "While the decision is as per expectations, it is important not to discount the RBI.¡±

The current slowdown in the economy is driven by liquidity issues, weak rural demand and slow credit off-take. Therefore, the RBI has chosen to adopt a ¡°neutral'' stance, it might impact liquidity and lending further.

RBI has kept the growth rate unchanged for the current fiscal year at 5 % and projected a pick up in the growth to 6 % in the next financial year.

The Monetary Policy Committee upped the inflation outlook for the second half of the next fiscal year by 0.30 per cent to 5.4 - 5 per cent and termed the whole outlook on price rise as ¡°highly uncertain¡±

The MPC said ¡°Economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain the status quo."

Moving forward the inflation prices are likely to get influenced by several factors such as food inflation, crude prices and input cost for services RBI said.

The government has estimated the growth in the GDP at 5 per cent in the current financial year with both domestic as well global factors in between weakening consumption demand in the country.