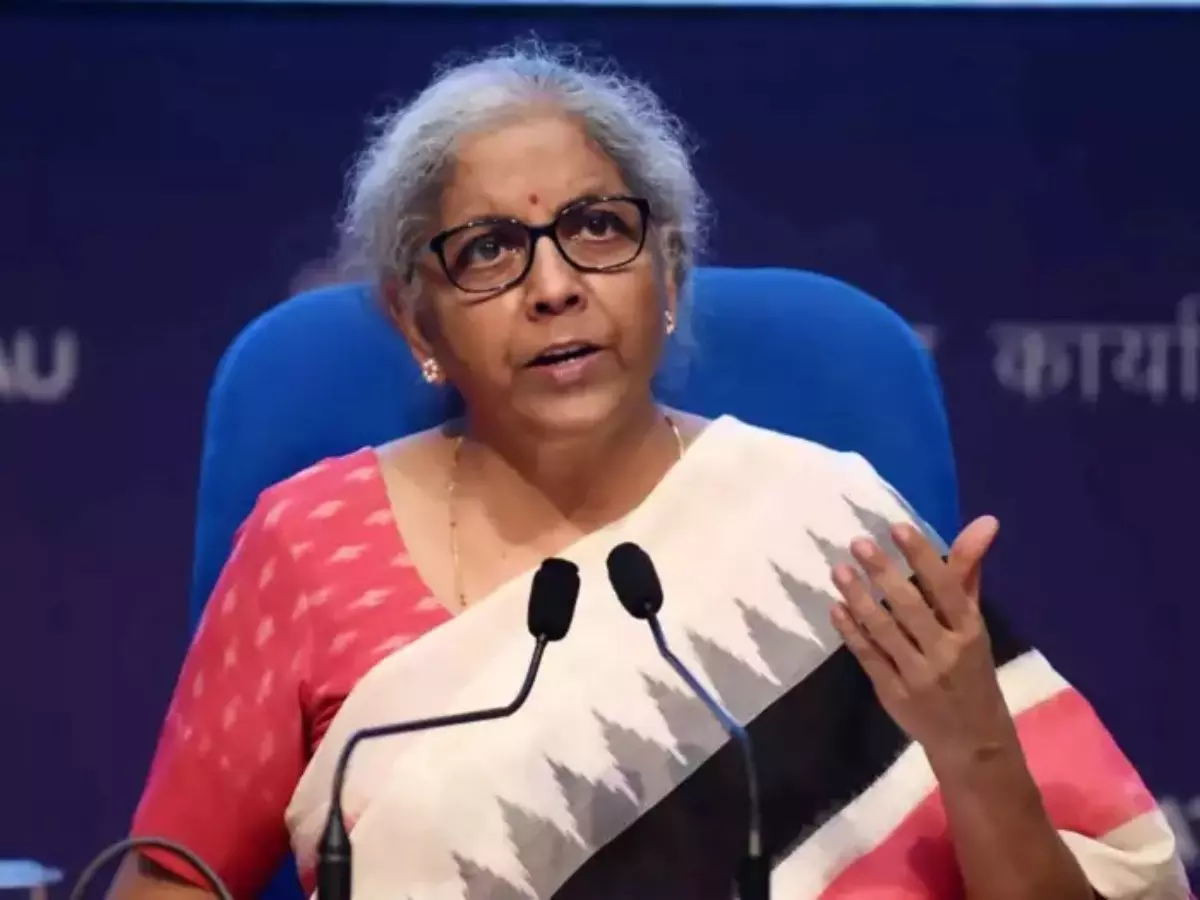

'Will Bring Petrol & Diesel Under GST Once State Governments Agree,' Says FM Nirmala Sitharaman

Three months after India¡¯s Petroleum and Natural Gas Minister Hardeep Singh Puri said that the central government is ready to bring petrol and diesel under the GST regime, Finance Minister Sitharaman has spoken on similar lines. While speaking at the post-budget session organized by PHD Chamber of Commerce and Industry, FM Sitharaman said ¡° Once states make up their mind on the timing of including crude oil and select petroleum products into Goo...Read More

Three months after India¡¯s Petroleum and Natural Gas Minister Hardeep Singh Puri said that the central government is ready to bring petrol and diesel under the GST regime, Finance Minister Sitharaman has spoken on similar lines.

While Mr Puri had not indicated any fall in fuel prices once GST gets implemented, various industry experts have been of the view that bringing petrol and diesel under the GST regime could lower fuel prices.

FM Sitharaman's Views On GST On Petrol & Diesel

indiatimes

indiatimes

While speaking at the post-budget session organized recently by PHD Chamber of Commerce and Industry FM Sitharaman said, ¡°Once states make up their mind on the timing of including crude oil and select petroleum products into Goods and Services Tax (GST) and determine a tax rate, these will be subsumed into the new indirect tax system.¡±

In response to a question on the roadmap for bringing petroleum products within GST, FM Sitharaman told industry leaders at the conference that the enabling provision for the same is already available.

¡°My predecessor had already kept the window open. Once the states agree, we will have the petroleum products also covered under GST," she said. At present, crude oil, petrol, diesel, aviation turbine fuel and natural gas are taxed by the Centre and states under their respective laws, i.e. excise duty on production and value-added tax on sales, as per Mint.

Also Read: 'Pizza Topping Is Not Pizza, So It Will Attract A Higher GST '

Need To Determine Rate & Timing

TOI/representative image

TOI/representative image

FM Sitharaman said these items continue in the old indirect tax regime not because the Centre does not want them, but because it requires the concurrence of the entire GST Council. ¡°...what they have to do is to determine a rate and once they tell me the rate, we (will) get it into the GST."

As per the report, FM Sitharaman also told the industry leaders that the government had kept micro, small and medium enterprises in mind while making the budget, which also emphasized on strong capital expenditure by the Centre and sustaining economic growth momentum.

At a separate interaction organized by industry body ASSOCHAM, FM Sitharaman said that the government¡¯s emphasis this year will be to execute the ?10 trillion capital expenditure plan. ¡°This year, my emphasis will be to reach the target of ?10 lakh crore actually getting absorbed through various projects in the different ministries, and also through the states which showed a very consistent appetite for receiving grants on capital expenditure," she said.

Also Read: Mumbai Man Arrested In Rs 132 Crore GST Fraud

For the latest and interesting financial news, keep reading Indiatimes Worth. Click here.