Microsoft Is Now A $1 Trillion Company, And It's All Thanks To One Man: Satya Nadella

Yesterday, Microsoft¡¯s valuation briefly went up into the trillions, joining the likes of Apple and Amazon in the elite club. Strong performance in the last quarter pushed the tech giant to the new height, largely thanks to the strategies of its CEO.

Yesterday, Microsoft's valuation briefly went up into the trillions, joining the likes of Apple and Amazon in the elite club.

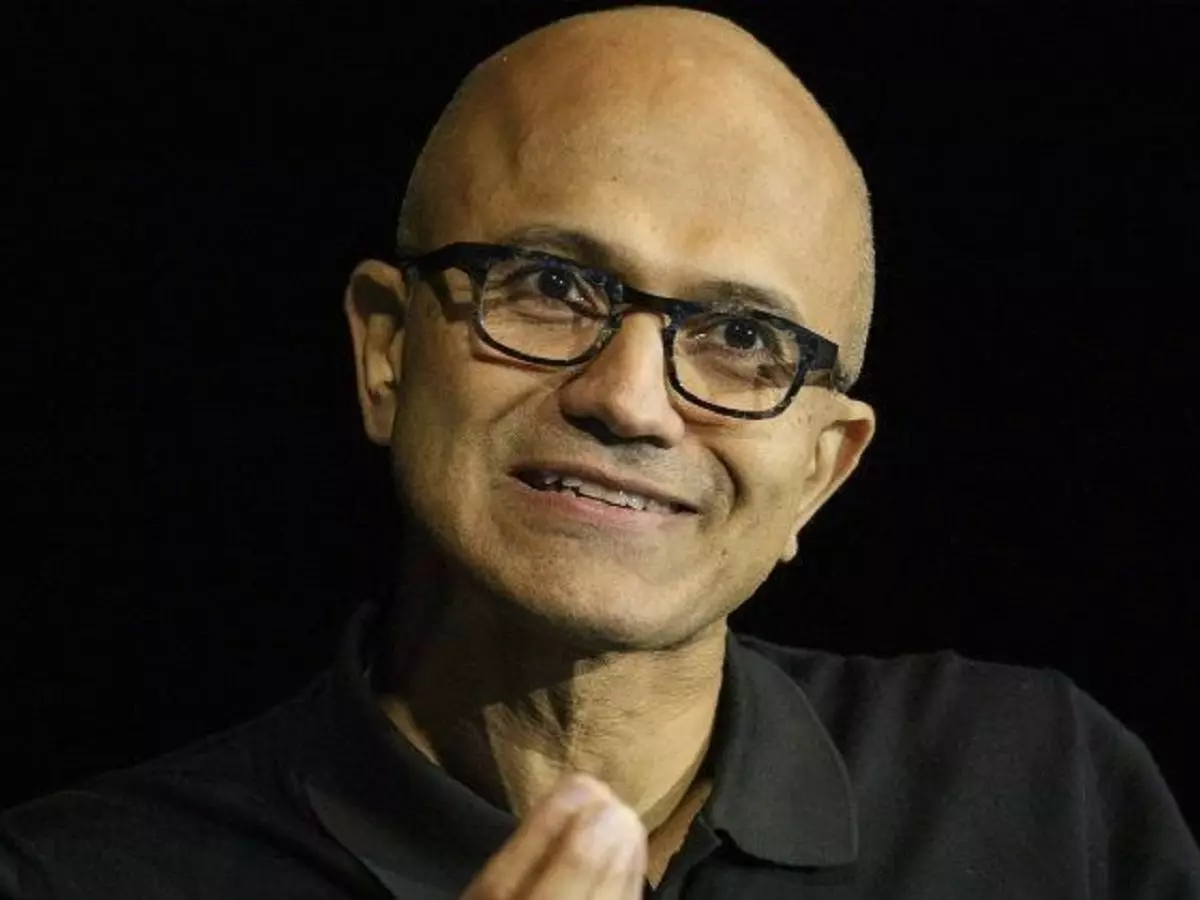

Strong performance in the last quarter pushed the tech giant to the new height, largely thanks to the strategies of CEO Satya Nadella.

Microsoft is the third company to enter the prestigious trillion-dolar club, even if only briefly. Interestingly, all three of those are tech companies. The company's valuation surged ahead yesterday after executives predicted continued growth for its cloud computing business while reporting the quarterly financials. Their stock rose to 4.5 percent during trading hours, before later falling just below $1 trillion by late afternoon.

Apple hit the milestone mark first, with Amazon a few months behind. Both have since fallen from that level but will probably rise again once they announce their quarterly results very soon.

What's important though is that Microsoft may not have even reached this level if not for the guidance of Satya Nadella. Under his leadership, Microsoft has moved away from being solely a software company to growing its cloud-computing business as well. In fact their growth is partly because, based on his instructions, Microsoft hasn't shied away from even partnering with competitors in order to achieve growth and reach more users.

And yet, Nadella isn't likely to do a victory lap. In fact, other executives at the company probably aren't going to celebrate either. It's not that Microsoft hates its success, the company just looks at it differently.

"This is a metric that nobody on the senior leadership team is tracking," Microsoft Chief Marketing Officer Chris Capossela said at an event last year. "Nobody is sitting around high-fiving when the stock hits some new high," Capossela said. "We are like 'wow, the bar just went up dramatically'."