Einstein Called It The 8th Wonder Of The World: Here's All You Need To Know About Compound Interest

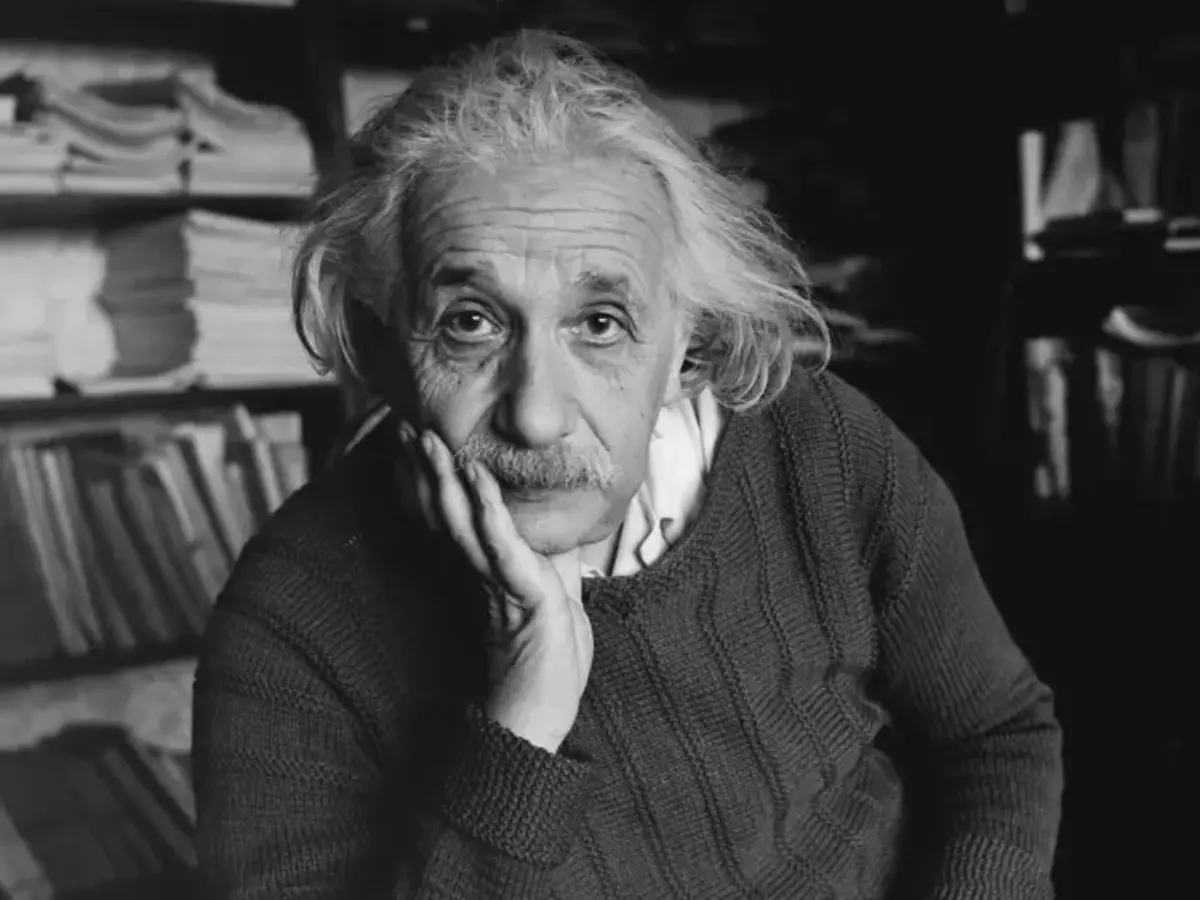

We all know that Albert Einstein is regarded as one of the world¡¯s greatest scientists and physicists. On the other hand, Warren Buffett is a name that needs no introduction in the stock market world.

We all know that Albert Einstein is regarded as one of the world¡¯s greatest scientists and physicists. On the other hand, Warren Buffett is a name that needs no introduction in the stock market world.

But did you know that the science genius Albert Einstein and ace investor Warren Buffett both recognised the importance and potential of one key aspect of investments- the power of compound interest?

Albert Einstein's Called It The 'Eighth Wonder Of The World'

malevus

malevus

Albert Einstein once called compound interest the eighth wonder of the world. Also, the magical power of compounding is something that has remained one of Warren Buffett¡¯s central principal investments.

¡°Compound interest is the eighth wonder of the world. He who understands it, earns it ¡ he who doesn¡¯t ¡ pays it.¡± ¨D Albert Einstein.

Warren Buffett has said that compound interest is an investor¡¯s best friend and compared building wealth through interest to rolling a snowball down a hill. ¡°I started building this little snowball at the top of a very long hill. The trick to have a very long hill is either starting very young or living to be very old.¡± Buffett had also once said, "My wealth has come from a combination of living in America, some lucky genes, and compound interest".

What should be learnt from Einstein¡¯s quote and Buffett¡¯s achievements is that beneficial actions today will provide much larger benefits over time, due to the power of compounding. Einstein¡¯s quote also highlights that if you don¡¯t understand compounding interest it will work against you. An example is the compounding of interest on loans, which is a disadvantage to you.

On the other hand, it¡¯s important to realise this ¡°eighth wonder of the world¡± can make you earn lots of money if done timely and wisely.

getty

getty

Also Read: How A Science Genius Lost Millions In The Stock Market

What Is Compound Interest?

Simply put, compound interest is the interest on interest. In simple terms, the addition of interest to the principal sum of the loan or deposit is called compound interest. In the long term, compound interest helps in growing your money exponentially.

Also Read: 10 Must-read Books For Youngsters To Understand Money Before Investing

Why The Power Of Compounding Is Important

getty

getty

The sooner you begin investing, the more time and scope you allow for the magical power of compounding to work wonders for you in the long run. It is one of the most powerful weapons that every person who became rich swears by. Compounding increases your invested money¡¯s value by getting the interest earned added back to the principal and thereby generating exponentially greater returns. This especially works wonders over the long term.

So, the power of compounding not only allows you to earn returns, but also re-invests your earnings (interest/dividend plus principal). This implies that you get to earn on both your principal as well as on your returns that were reinvested into your principal. And the longer you stay invested, the higher would be the power of compounding!

Also Read: How Stock Market Trading Is Different From Investing

Example To Help You Understand Better

The early bird catches the worm is an adage most of us must have heard. This holds true when it comes to investing and utilizing the power of compounding.

Here is an example to further emphasize the power of compounding. Let us assume you invest Rs 5,000 per month, at an expected rate of return of 8% p.a., for a tenure of 10 years.

Using the compound interest calculator tool, you would accumulate and redeem approximately Rs 9.2 lakh at the end of 10 years. However, if you remain invested instead of redeeming the accumulated corpus, the corpus, thanks to the power of compounding, keeps growing to Rs 13.52 lakh in another 5 years, Rs 19.8 lakh in another 10 years, Rs 29.2 lakh in another 15 years, and so on.

So the longer you stay invested, the more exponentially your money grows due to the power of compounding.

Also, if you have set financial goals in life, the power of compounding can help to a great extent, as the earlier you begin investing, the more time you allow for your money to grow and benefit from the power of compounding.

For example: a 25-year-old can accumulate a corpus of close to Rs 25 lakh by beginning to invest just Rs 5,000 monthly till the age of 40 years in equity mutual fund SIPs (assuming a conservative expected rate of return of 12%). Whereas for the same corpus to be created by the age of 40 for someone beginning much later at the age of say, 32, a much higher SIP monthly contribution of close to Rs 15,000 would be required.

For the latest and more interesting financial news, keep reading Indiatimes Worth. Click here.