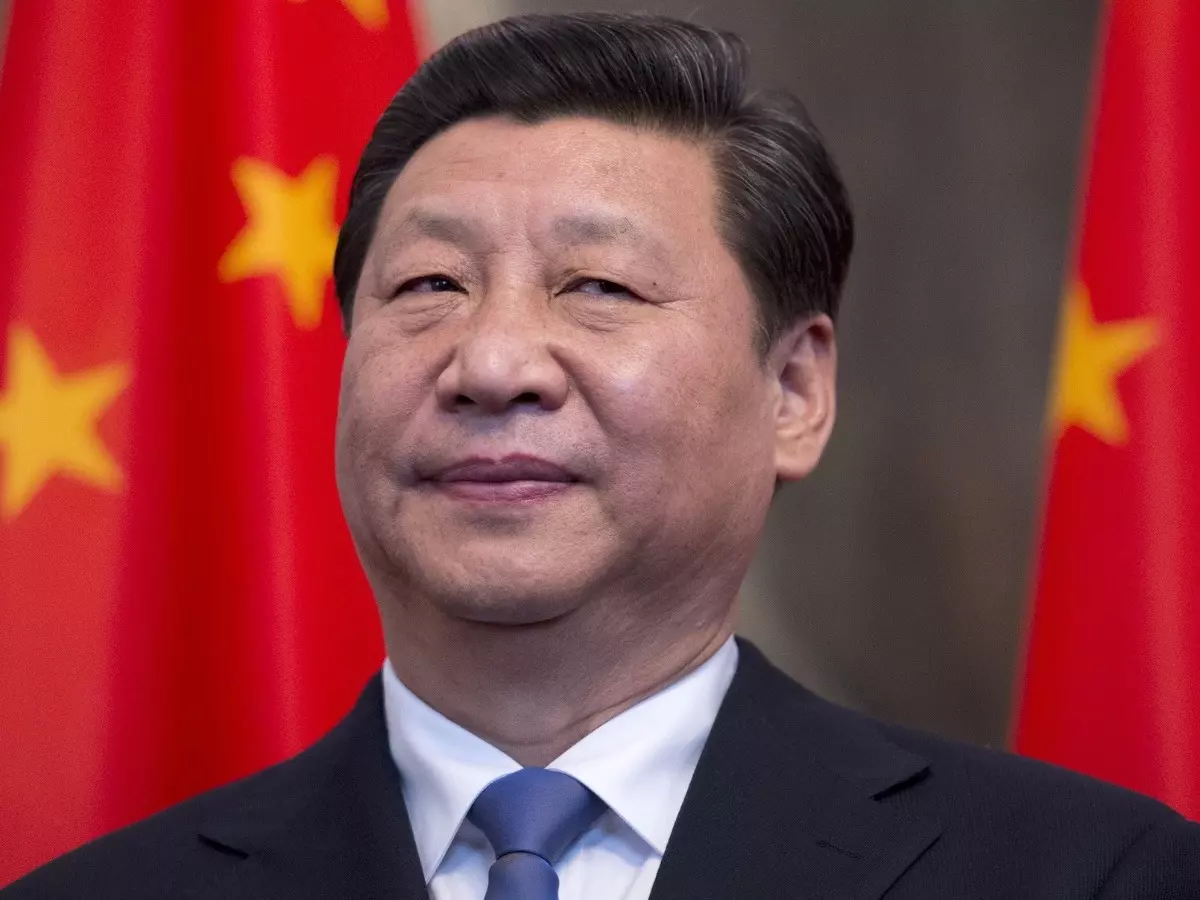

Top Chinese Stocks Crash Nearly $70 Billion In U.S. After Xi Jinping Gets Third Term As President

China¡¯s 69 year old President Xi Jinping has extended his rule as the country¡¯s leader for the third term. The ten biggest New York-listed Chinese companies lost a total of $67.7 billion in market capitalization, with each firm falling by 8% or more. This bloodbath was led by the two largest firms, i.e. online retailer Alibaba and technology company Pinduoduo, facing 13% and 25% losses, respectively, as per Forbes.

For a precedent-breaking third term, China¡¯s President Xi Jinping has extended his rule as the country¡¯s leader. The 69-year-old was re-elected as the general secretary of the Communist Party a few days back, following China¡¯s national congress confirming his status as the country¡¯s most powerful leader since Mao Zedong.

His appointment means that he will be in firm control of the world¡¯s second-largest economy for at least another 5 years, at a time when it increasingly finds itself on a collision course with the U.S., as per a Forbes report.

Although his securing the third term was not a surprise move, Chinese stocks did manage to surprise the market and indulged in a bloodbath. Shares of the largest Chinese companies listed on U.S. exchanges tanked by as much as 25% on Monday, after Chinese President Xi Jinping secured an unprecedented third term.

shutterstock

shutterstock

The ten biggest New York-listed Chinese companies lost a total of $67.7 billion in market capitalization, with each firm falling by 8% or more. This bloodbath was led by the two largest firms, i.e. online retailer Alibaba and technology company Pinduoduo, facing 13% and 25% losses, respectively, as per Forbes.

The decline extended throughout the more than 200 U.S.-listed Chinese firms, with the weighted Nasdaq Golden Dragon China Index falling 14.4% on Monday.

The nosedive came even as China reported better-than-expected economic growth and the rest of the U.S. market broadly gained, with the Dow Jones Industrial Average and S&P 500 up 1.3% and 1.2%, respectively, the report mentioned.

Also Read: How China Is Filling The Void In Russian Market

Losses in China As Well

And that¡¯s not all. Losses were felt in China as well, as the Hang Seng China Enterprises Index, which measures Hong Kong-listed Chinese stocks, fell 6.4% on Monday, and the Chinese yuan rose 1.3% to 7.32% against the dollar in offshore trading, its cheapest level since tracking began in 2010.

Even Jack Ma, Alibaba¡¯s billionaire co-founder and largest shareholder too lost a mammoth $900 million on Monday, thus sending his net worth down to $20.5 billion, according to our calculations. Ma¡¯s fortune is less than half of what it was in early 2021.

Overall, the U.S. market cap of the 10 largest Chinese firms is down 75% from their $1.6 trillion peak in February 2021, sitting at $401 billion Monday, as per the Forbes report.

What Xi Jinping Said About The Market

shutterstock

shutterstock

Upon securing his third term, Chinese President Xi said that the country ¡°will strive harder to achieve the Chinese dream of national rejuvenation,¡± a term that largely means transforming the nation into a global power with higher standards of living and advanced technologies comparable with those in the West.

President Xi also did give some reassurances to market watchers. He reportedly said that China would continue to open up, and resolutely deepen reform. The country¡¯s economy has shown perseverance and great potential, and its strong fundamentals ¡°will not change.¡±

Also Read: India's Rs 100 lakh Crore Project To Snatch Factories From China

For the latest and more interesting financial news, keep reading Indiatimes Worth. Click here.